Navigating the Ripple Effects: How Trump’s Policies Amplify Global Economic Risks

Introduction

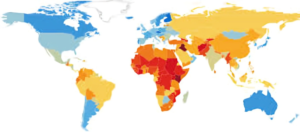

The global economy stands at a crossroads, buffeted by geopolitical tensions, supply‑chain disruptions, and uneven recoveries from recent crises. Among these forces, the policy decisions of the United States carry outsized influence. In particular, the leadership style and regulatory shifts introduced under former President Donald Trump continue to cast long shadows over international markets, central banks, and fiscal authorities. Understanding the ongoing impact of these policies is essential for businesses, investors, and policymakers aiming to chart a steady course forward.

Assessing the Current Landscape

As economies around the world strive to rebound, central bankers and finance ministers remain keenly aware of several Trump‑era policy legacies that still shape risk perceptions:

- Trade Tensions and Tariffs

- The imposition of broad tariffs on imports from major trading partners disrupted supply chains.

- Retaliatory measures have injected uncertainty into manufacturing investment decisions.

- Regulatory Rollbacks

- Financial deregulation measures loosened banking oversight, prompting concerns about systemic vulnerabilities.

- Environmental rollbacks have altered energy markets, affecting commodity prices and investor sentiment.

- Geopolitical Posturing

- “America First” rhetoric strained alliances, raising questions about the stability of multilateral agreements.

- Sudden policy announcements via social media amplified market volatility, as investors scrambled to reassess risk.

Central Bank Responses

Despite divergent mandates, major central banks have found common ground in addressing elevated policy‑driven risks:

- Federal Reserve: Emphasizes flexible inflation targeting to respond to supply‑side shocks.

- European Central Bank (ECB): Maintains ultra‑accommodative stance while preparing for potential interest‑rate adjustments.

- Bank of Japan: Focuses on yield‑curve control amid protracted low growth concerns.

Key actions under discussion include:

- Liquidity injections to stabilize short‑term funding markets.

- Forward guidance calibrated to cushion the economy against unexpected policy shifts.

- Cross‑border coordination to prevent “policy spillovers” from exacerbating global financial stress.

Real‑World Examples

Consider two illustrative scenarios:

- Manufacturing Firm in Germany:

After facing U.S. steel tariffs, the firm relocated parts of its supply chain to Southeast Asia. Ongoing uncertainty over renewal or rollback of tariffs under a new administration has slowed its capital expenditure plans. - Emerging‑Market Bond Investor:

Following dovish signals from the Fed, yields on emerging‑market debt dropped, offering a window for new investments. However, abrupt trade‑policy announcements can still trigger sharp sell‑offs, underlining the need for nimble risk management.

Strategies for Stakeholders

To navigate these choppy waters, stakeholders should consider the following best practices:

- Enhanced Scenario Planning

- Model multiple policy‑change scenarios, from tariff hikes to regulatory reinstatements.

- Stress‑test balance sheets against sudden shifts in funding costs and currency valuations.

- Diversification of Supply Chains

- Establish multi‑regional supplier networks to reduce dependence on any single market.

- Monitor geopolitical developments continuously to preempt disruptions.

- Active Engagement with Policymakers

- Industry associations can lobby for clarity and predictability in trade and regulatory frameworks.

- Central‑bank outreach programs offer channels to express private‑sector concerns.

- Dynamic Hedging Strategies

- Use options and swaps to hedge against interest‑rate volatility and currency swings.

- Reassess hedge ratios regularly as policy outlooks evolve.

Looking Ahead: Balancing Growth and Stability

While the direct tenure of any administration is finite, its policy imprints can endure for years. Central banks must remain vigilant, calibrating monetary settings to offset residual shocks from past policy moves. Simultaneously, governments and businesses should prioritize resilience—balancing the pursuit of growth with robust risk frameworks. As global policymakers convene at forums like the G20 and IMF meetings, one clear message emerges: cooperation and transparency are vital to dampening the disruptive aftershocks of policy pivots.

Conclusion

The legacy of Trump’s policy agenda continues to reverberate across international markets, compelling central banks and private‑sector actors to adapt. By embracing proactive risk management, fostering diversified networks, and engaging constructively with policymakers, stakeholders can not only weather the current storms but also lay the groundwork for a more stable, predictable global economic environment. Vigilance and adaptability remain the watchwords as we move into an era where policy choices—domestic and foreign—hold the power to reshape economic trajectories worldwide.

VISIT HOME PAGE VIEW MORE ARTICLE