Maruti’s July 2025 Sales Surge to 180,526 Units, Fuelled by 32% Export Growth and Strong Compact Car Demand

Introduction

July 2025 was a landmark month for Maruti Suzuki India as total sales jumped to 180,526 units, up from 175,041 in July 2024. This 3.1% year-on-year rise was complemented by an even stronger month-on-month gain of 7.5% over June’s 167,993 units. While the mini-car segment struggled, exports and compact cars drove Maruti’s growth, underscoring the brand’s resilience amid shifting consumer preferences. In this article, we dive into the numbers, explore segment-wise trends, and highlight what this means for buyers and dealers alike.

Overview of July 2025 Performance

- Total Sales: 180,526 units (July 2024: 175,041; June 2025: 167,993)

- Year-on-Year Growth: +3.1%

- Month-on-Month Growth: +7.5%

Key drivers:

- Exports: Strong 32% rise to 31,745 units, reflecting healthy global demand.

- Compact Cars: Robust pickup in Baleno, Swift, WagonR and others.

- Entry-level Struggles: Mini cars (Alto, S-Presso) saw sharp decline.

Segment-wise Analysis

Mini Car Segment

- July “mini” sales fell to 6,822 units (July 2024: 9,960)

- YTD (Apr–Jul 2025): 26,344 units vs 40,776 last year

- Drivers: New-model delays, growing buyer preference for slightly larger hatchbacks

Compact Segment

- July compact sales rose to 65,667 units (July 2024: 58,682)

- Popular models: Baleno, Celerio, Dzire, Ignis, Swift, WagonR

- YTD compact + mini combined: 72,489 units vs 67,?

- Takeaway: First-time urban buyers still favour small but feature-rich cars

Mid-Size Sedan (Ciaz)

- July sales dropped sharply to 173 units (July 2024: 603)

- End-of-life cycle model seeing phase-out in favour of newer UVs

Utility Vehicles (UV)

- July UV sales at 52,773 units (July 2024: 56,302), down 6%

- Key models: Brezza, Ertiga, Fronx, Grand Vitara, Invicto, Jimny, XL6

- YTD UV sales: 214,641 vs 219,432 last year

Light Commercial Vehicles (LCV)

- Super Carry sales at 2,794 units (July 2024: 2,891)

- YTD LCV: 11,304 vs 10,837, showing slight recovery

OEM Supplies & Exports

- Supplies to other OEMs: 8,211 units vs 10,702, as rival brands boost in-house capacity

- Exports surged to 31,745 units from 23,985 in July 2024

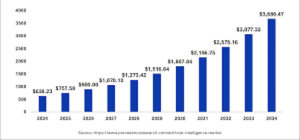

- YTD exports: 128,717 vs 94,545, up 36%

Real-World Impact: Dealer and Buyer Stories

- Dealer Perspective: Many showrooms reported waiting lists for Baleno and Swift. “Customers ready to book, but waiting for test-drive slots,” says a Delhi-NCR dealer.

- Buyer Story: Rohit from Pune upgraded from Alto to WagonR, citing more cabin space and features at only a marginal price jump.

Such real-life shifts illustrate how Maruti’s mix is evolving: buyers stepping up from mini cars into compact hatchbacks and entry-level UVs, while global demand helps smooth domestic ups and downs.

Conclusion and Outlook

July 2025 results show Maruti Suzuki’s adaptability: strong compact sales, record exports, and steady LCV performance cushion mini-car headwinds. Looking ahead:

- Upcoming Launches: Rumoured facelift for S-Presso and new compact SUV may boost mini and UV segments.

- Product Mix: Continued export growth likely, with newer models appealing to global markets.

- Dealer Preparedness: Managing test-drive demand, and stock of popular models will be key.

Maruti’s July momentum suggests a cautiously optimistic auto market for the rest of 2025, with buyers’ preferences steadily shifting toward feature-loaded, slightly larger segments. Dealers and Maruti both will need to align inventory and marketing to capture this evolving demand.