Rupee Rallies Against Dollar Amid Tariff Fears

A fresh start for India’s currency saw the rupee edging up against the US dollar today, even as whispers about fresh US tariffs on Chinese imports kept traders on their toes. Investors woke up to firmer numbers, hoping that global trade tensions won’t spiral into a full-blown currency rout.

Introduction

The open bell in Mumbai marked a positive note for the rupee, which traded stronger despite headlines warning of escalating Trump-era tariffs. This surprising resilience comes amid mixed signals from global markets, with some investors betting that India’s economic fundamentals will hold firm. In this article, we explore why the rupee rose, what factors are at play, and what traders can expect in the near term.

Market Opening Snapshot

- Traders noted the rupee opened at around ₹74.10 per dollar, up from yesterday’s close of ₹74.25.

- Domestic equity markets also showed green, with the Sensex gaining 0.5% in early trade.

- Crude oil prices, a major input cost for India, remained steady around $67 per barrel—supporting the domestic currency.

These numbers hint that, for now, the rupee is shrugging off tariff jitters.

Why Tariff Talks Matter

President Trump’s recent threats to levy extra duties on up to $200 billion of Chinese goods sent shockwaves through global markets. India watches closely, since any trade war escalation can:

- Raise global financial volatility

- Push safe-haven flows into the dollar

- Hit emerging-market currencies, including the rupee

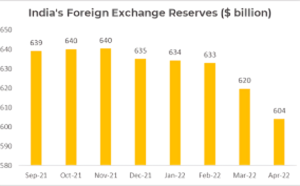

Still, many traders believe that India’s relatively stable current-account position and strong foreign exchange reserves act as buffers against sudden shocks.

Domestic Factors in Play

Several India-specific elements helped the rupee stay firm today:

- Foreign Inflows: Continued inflows into Indian equities and bonds added dollar liquidity.

- Reserve Levels: RBI’s forex reserves stand near a record high, above $450 billion, giving confidence to markets.

- Economic Data: Recent data showed retail inflation cooling to 5.2% year-on-year, below market expectations—easing rate-cut hopes but still positive for currency.

Real-life example: In July last year, when global oil prices spiked, India’s reserves cushioned the rupee from falling below ₹70. Today’s reserves play a similar protective role.

Outlook and Trader Tips

While today’s rise feels good, experts warn not to get too comfortable. Here’s what to watch:

- US Fed Minutes: Any hawkish tilt in upcoming Fed minutes could lift the dollar again.

- Crude Trends: A sudden jump in oil prices (above $75) could strain the rupee.

- Monsoon Data: Below-average rains may spur food inflation, pressuring the RBI to keep rates higher.

Quick Tips for Traders

- Use stop-loss orders near ₹74.50 to limit downside risk.

- Consider short-tenor forward contracts if you expect rupee weakness.

- Keep an eye on global bond yields—rising US yields often boost the dollar.

Conclusion

Today’s stronger opening for the rupee shows that solid domestic buffers can counter global trade uncertainty, at least in the short term. However, looming tariff threats and volatile oil markets mean currency swings may return. For now, traders can enjoy a slightly brighter start—but staying vigilant remains key.